|

|

Centre for Humanitarian Assistance Trust works with the indigenous communities, |

|

“To establish a just, egalitarian social order through the participation of communities to create self sustenance and self reliance for individuals, Families and Communities” |

SHG’s Seed Capital for MarketingGOAL To provide capital to the Self Help Groups and market-enable them so that they are able to eliminate the middlemen Revolving Capital Fund

The philosophy of humanitarian assistance and intervention demand that a community does not feel its self-esteem diminished for being a beneficiary. Financing community efforts through a Revolving Credit Fund provide a framework for both dignity and uninterrupted availability of a seed capital that is commonly owned and managed by the community. This form of intervention is at the core of how CeFHA and its partners approach the assistance they provide and defines their very own existence as an NGO. Objectives

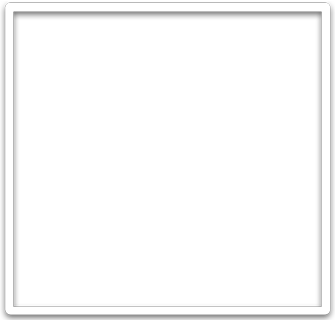

A Womens Co-operative - Process of Women EmpowermentKotauratla is a mandal in Vishakhapatnam district in the state of Andhra Pradesh in India. It is the Taluka headquarter for surrounding 72 villages. A famous temple Uma Maheswaralayam, and Kodanda Ramalayam is situated in this mandal. Varaha river passes through this village. Agriculture is the main occupation of this village producing sugar cane, paddy and maize. More than 1000 professional came from this village which shows the education level of the village. The total literacy rate is 65%. Being remote village it also one of the best tourist place in Andhra Pradesh with unusual hills with thick trees all over the village. Kotauratla has a population of 7003 in which 3590 are male while 3413 female as per census 2011. kotauratla has lower literacy rate of 66.95% compared to 67.02% of Andhra Pradesh .The male literacy rate is 74.20%and female rate was 59.28%.SC population is 1849 and ST 118. Out off total workers 2,653 the main workers are 1966 and marginal workers 687. Centre for Humanitarian Assistance Trust (CeFHA), a voluntary organisation is working in the backward districts of Visakhapatnam covering 36 villages with a package of Integrated Development programmes for the upliftment of the poor Adivasis and Dalits with the support of other partners. Among the many programmes like children empowerment, community health, sustainable agriculture, social forestry, formation of federations and networks, SHGs are a few major programmes. The project emphasises more on the development of children, family, SHGs and community. The current initiative has a focused derived objective on SHGs to manage the thrift and credit programme in the area. CeFHA is registered in 2002 to address children, health & nutrition education and communication programmes. Due to cultural bondage, the poor Adivasi & Dalit women were unable to come out of their situation in a vocal way, and there was less participation of women in the community meetings. There was a desired need to focus on women and form women groups so that the women can collectively address their problems. The Child Focused Community Development (CFCD) project commenced in the year 2006 with the support of KNH, Germany. CeFHA began its journey with children focusing on education, health and nutrition. The families are involved in participatory rural appraisal exercise, which has helped to identify the skills they possess, knowledge they have and resources they own; the community health and sustainable agriculture programme was initiated through communities participation. The women groups actively emerged in the area of 1st Phase 16 villages in 2006 and in the 2nd phase 20 villages from 2013. This has given a real strength to form self help groups. Formation of Self Help Groups: Introduction: Self Help Groups are novel and innovative organizational setup in India for the Women upliftment and welfare. All Women in India are given a chance join any SHGs for training and development so as to be prospective entrepreneurs and skilled workers. The SHGs are promoted for enhancing the capacity of the women in terms of leadership. In Kotauratla Mandal 100 Self Help Group have been formed with 15 to 20 members in each village. Today, in 36 villages, with a membership of 1384 are actively involved in self-help initiatives. These groups have been formed to: 1. Save small amount of money regularly. The Concept: “Unwinding Traditional Saving Approach to a Trnsormative and a Modern Novel Way of Savings”.The SHGs are able to mobilize small savings either on weekly or monthly basis from persons who were earlier not expected to have any savings. They have been able to effectively recycle the amount generated among the members for meeting the emergency credit needs and also for their small business purposes of member groups. The Process of Micro Credit Initiative Microcredit - the extension of small loans gives people who would otherwise not have access to credit the opportunity to begin or expand businesses or to pursue job-specific training. These borrowers lack the income, credit history, assets, or security to borrow from other sources. Its appeal comes from its capacity to provide the means for those who have the ability, drive, and commitment to overcome the hurdles to self-sufficiency. Continuous education and work focused with the women to strengthen their unity and build a strong leadership among them was a prima facie factor in institutionalising the process of money rotation. The members in this case the women, participate in planning, decision making, implementation and monitoring of all the activities. These groups are capable to mobilise women to come together on common issues like liquor, equal and fair wages, battered women, land ownership, property rights and forest issues both at micro and macro levels. A sense of thrift to remove the threats of traditional credit practices became an important agenda for the empowerment and development of the communities. This led the project to initiate individual savings concept by reducing the unproductive expenses on liquor, ceremonies, marriages, and festivals and converting them into a more productive way of securing finances by using it in promoting a skill into entrepreneurship and utilise the fund in the time of distress.  Objectives of Micro Credit Initiative

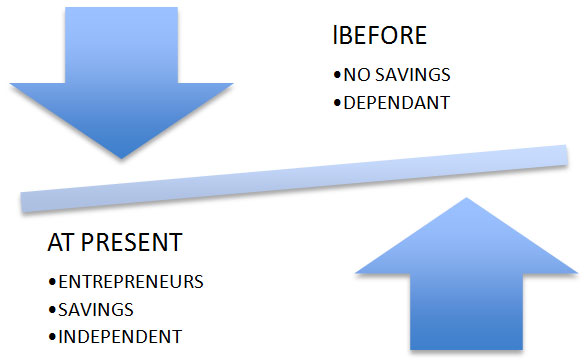

Micro Credit Management: The management of the micro-credit is simple. Each credit committee of the women groups selects the President, Vice President, Secretary, Treasurer and other members to manage the financial affairs. Each committee selects two women from among the existing members to open and operate an account jointly at the local Bank. Every month Rs. 5 to Rs. 20 is collected from each member and the same is deposited in the bank. Each group collects Rs 350/- to 450/- per month. So far, the Women Groups have raised an amount of Rs.13, 50,178/- and kept the amount in the Bank. At present, the micro-credit programme is carried out in all the 36 villages. The women credit committee meets every month to discuss on the activities of the group and the members collectively take decisions to sanction any loan to its members. The rate of interest charged on borrowing is fixed at 12% -24 % per annum i.e. Rs. 1-2/- per month for Rs. 100/-. If anybody fails to repay, the group takes action by fixing an additional amount (double the interest) along with the credit basing on the economic status of the person borrowed. However, the SHGs follow some guidelines and criteria on repayment, interest, loan availability to the poor families, prioritisation of the purpose of loans, family needs and economic position, credit worthiness and repaying capacity, maintenance of accounts and upkeep of records. Repayment procedures and interest norms differ from village to village.  In every village, the SHGs decide the rate of interest, instalments to repay and how much to repay and develop appropriate mechanisms if any member fails to repay the loan borrowed. Sometimes the extension of the repayment period is considered if any unavoidable circumstances the borrower may face. In such cases the borrower shall inform the women's group for extension of the repayment period. At any cost the loan given is neither written off nor subsidised. The members of the group who are in need are eligible to receive a loan ranging from Rs.1500 to Rs.2500/-. The loan is given towards short term productive ventures like vegetable marketing, Milk business, fish business, goattery, poultry, spice processing, broom binding, tea shops, Tiffin shops, Chuda, bangles, Dry fish, meat shops, Vegetable and fruit shops. Capacity Building Programme for MACTCS Members The project imparts training to the members of the Women Groups/SHGs and its Office Bearers on managing the Credit Committee and running the Women's Group. For Value Addition of their produces different skill trainings are conducted and to sell their finished produces entrepreneur skills are imparted. Following these trainings, the selected persons are given training in Income Generation activities and are assisted through production units. Basing on the availability of raw materials, up -gradation of the traditional skills like Palm Fibre; Bamboo Basket Weaving and Craft, Lacquer toys; Carpentry, Tamarind Processing, Spice Processing,& Food processing; Herbal hair oil; Pickle making Natural Dye Processing, Detergents Making, Leaf Plate Making and Honey Extraction are undertaken. The trained women carry the products to the weekly markets and to the nearby industrial towns to sell their products. Some of them participated in exhibitions organised by Government. Co-ordination and Monitoring Micro-Credit The Society organises quarterly meetings for the women group members to co-ordinate and monitor operations of the fund and credit mechanisms, problems faced and solutions sought. These quarterly meetings also provide a space for the different credit committees to form into a network of credit committees. The impact of Micro Credit

Micro-credit will have a little impact, unless it is accompanied by proper and effective capacity building activities in the areas of leadership, values collective sharing and participation, communitarian and just values, democratisation of groups, education, health, communication skills, entrepreneur and marketing towards sustainable development. Focus: CeFHA is working for Social and Economic Development. It has undertaken Economic Development as thrift and credit activity for the last one decade with our most vulnerable Dalit and Tribal women. Now as per the demand of the members we federated them and registered as Jhansi Mactcs under Mutually Aided Co operative Societies Act on 29th January 2016 Economic Benefits:- 1. This Thrift and credit gives members economic security in times of financial hardship and gives them an opportunity to exploit their opportunities and make more money in better times Social Benefits:-

1.This is most beneficial for women to get special recognition at home and society, it will lead to increase self respect. Political Benefits:- This programme will provide an opportunity to be elected as PANCHAYAT Members for decision making posts. We have to encourage livelihood enhancement activities so that the schemes of Govt. will be tapped judiciously into the needy entrepreneurs. Registration of Women Groups as Jhansi MACTCS(A step towards Women empowered Banking Entrepreneurship)Jahansi Laxmi Mahila Mandala Mutually Aided Cooperative Thrift and Credit Society Ltd kotauratla Jahansi Laxmi Mahila Mandala Mutually Aided Cooperative Thrift and Credit Society Ltd (Registered under AP Macs act 30of 1995) registered on 29-01-2016 with registered No:AMC/VSP/DCO/2016/4147. The main objective is to promote economic and social betterment of its members through thrift, Self Help and Mutual Aid in accordance with the principals of cooperation. Mrs.Chinnari is the chief promoter of this society. The activities and services are to:

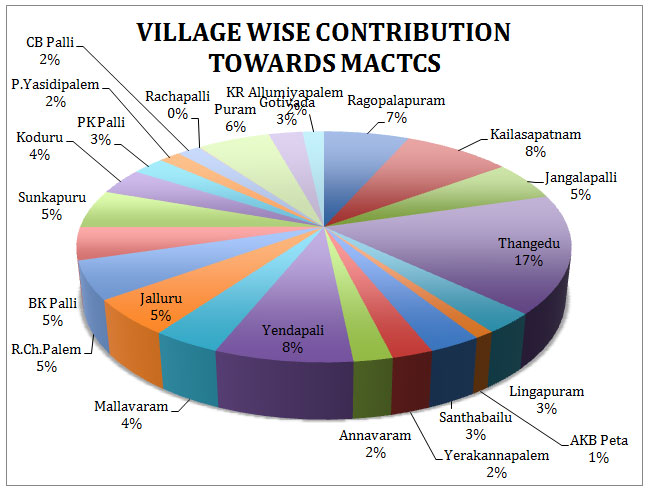

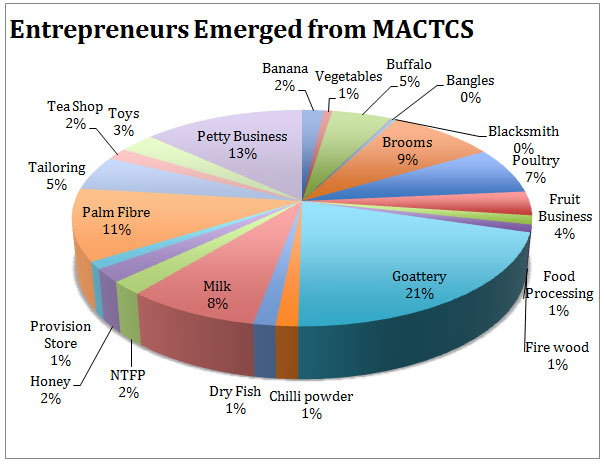

1. Encourage and afford habit of thrift and savings among the members. The Society provides short term loans to its members on a nominal interest it also provides education loans, housing loans and pension schemes to its members. At Present 54 SHGs from 22 villages became the share holders and raised Rs.3,51,636/- in the Bank at Kotauratla. Each member invested a share of Rs.200- 1000/- as capital investment in the Cooperative Society. A total number of 662 members invested from 22 villages.These groups are also engaged in processing agriculture and forest based materials like vegetables, spices, honey, tamarind, and Herbal hair oil , leaf plates , petty sales, palm leaf marketing , coconut brooms, dairy, toy units and goatery. The Journey so far so good… As soon as the MACTC was formed it kicked into action within no time, out of 36 Villages nearly 23 villages have already invested in MACTC society with a percentage of share as depicted in the graphical representation below, the 13 villages also would be a part of this share process very soon. This has helped the women in the villages to be motivated and keep the entire fraternity of MACTC too motivated.  Apart from that there are many women who have already become entrepreneurs and this being a success in itself the women have ventured in to different kinds of businesses – this not only provides self sufficiency in terms of finances but it also gathers a lot of self respect and self morale. The graph below depicts the kind of business the women ventured into. MACTC has now given a new dimension and this model is now proving to be a self sufficient model.  Conclusion: To conclude, credit is one of the inputs in the process of empowerment and change. Credit can only be effective when it is understood as one of the aspect of an integrated set of support services to strengthen the poor women's economy. When money is being given as a loan the prime concern is that it should be repaid. Credit to poor women has to be seen as a process of enabling them to stabilise their livelihood system. CASE STUDIES ON SELF HELP GROUPS- PRODUCTION UNITS1. CASE STUDY ON SELF HELP GROUP - TOY UNITINTRODUCTION

Gottivada village Belongs to the Gram panchayat Rama Chandra Palem 4km.This village comes under the Kotauratla mandal. CeFHA is working with 32 families of Dalit community and the is population 136.All the families are depending on labor work and migration to neighboring districts for agriculture or contract works in search of livelihood. The project organized PRA Exercise in the village in the 1st year of intervention to empower women and generate income& food Security to the community and quality of life. CeFHA has formed two women groups in the village. CeFHA has been identified the women issues like unfair wages, unequal wages, mortgage, landlessness, bondedness, liquor problem and battered women problem, Children ill health , malnutrition and Children dropout and never enrolment in the schools and child laborers. Through the food exercise the Project understood the vulnerable families in the village and identified the Traditional skills in the village. Training programs:The Project has intervened and followed a principle to make the women self sustainable. Every woman has their own traditional skills like palm fiber extraction, which is very hard and tedious for the women and get very low income after marketing in the village. Almost all the women in the village work in the rainy season or they go for migration to outside the village or in the district. Normally the men take the lease the palm trees and cut the leaves and they bring to the women to extract the fiber. All the Hard work will be done by the women ; after extracting the men take it to the market and sell it or with in the village the middle men comes and take it. The whole profit goes to the middlemen and the women were exploited in getting the right prices.

The project surveyed and identified the local demand products like lacquer toys, where the raw material easily available from the forest. The project discussed with the women group in the village Gottivada. It took nearly three months for the women to take a shift from their original traditional skill to learn a new skill of lacquer Toys. Earlier the Self Help group members were trained in Income generation programme like Surf making, Vim powder, Vaseline and marketing with in the village and outside the village. The new skill was imparted to 6 families in the village Gottivada. After the completion of the training program the project has been established two toy units to work for four families to produce toys in the village. The wood is collected from the nearby forest or some times the women are also buying the wood from the local persons. The Lac was dyed with natural colors and applied on the wooden toys. There was a good demand for the natural dye toys than the chemical dye toys. The women were trained in the natural colors. Process in Toy Production with Natural Dyes Unit:The Self Help group members produce colorful lacquer wood toys like, Candle- stand, Ganesh, Veena, Hair clips, toys, in the village . The process of making the wooden handicrafts is called Turned Wood Lacquered Craft (Tharini) and the wood is collected from the locally grown Ankudu tree. The proximity to the forest area with plenty of yield of Ankudu Karra, a light and non timber species of wood.The dye the artisans use is from various trees and plants in the area. Lacquering is done on a lathe, by hand or using machine. For turning slender and delicate items, the hand-lathe is preferred. Lac is applied in a dry state. The process involves the pressing of lac stick against the rotating woodenware. As the latter keeps, revolving the heat from the friction softens the lac enabling the colour to stick. As these articles are made by using lathes, they are called "Turned Toys"  Making Natural dyes:There is a specific procedure for preparing different dyes. The raw material derived from different parts of various trees or plants are powdered and boiled to form a thick solution till it starts producing lather. The concentrates are then filtered. The colours and shades depend on various factors - such as the temperature at which it is boiled, duration of boiling, quantities of water and raw material boiled. For instance, to prepare a concentrate of red or orange, one kg seeds of Bixaorellana are mixed with two and half (2 1/2) litre of water and boiled on a small domestic oven for twenty to thirty minutes. The concentrate is cooled and filtered to mix with lacquer. However, some colours have a complex and systematic process of preparing the concentrate. Economics of the products:The women are having their own works in earning of livelihoods as well as household works in the house. Apart from these daily routine works they are spending in a day one to two hours in toy making unit. Each family is expert in one particular toy and became very skill full, the production goes to the nearby market place Yetikoppaka every weekend or once in 15 days. The women invest for 15days only Rs. 500/- to Rs.600/- and they are getting Rs.1200/- to Rs.1500/- Investment for 15 days:

SHG-Lacquer ware wood Toy products

2. TAILORING UNIT CASE STUDY- CHOWDUWADASELF HELP GROUP TAILORING UNITINTRODUCTION:Chowduwada village belongs to Panchayat headquarters and it comes under Kotauratla mandal & police station limits 7km. Different communities live together in the village Chowduwada. The project began its work Project is working with dalith community; there are 39 families and 195 populations. All the families are depending on Agriculture labor work and some families are depending on extraction palm fiber and some families are depending upon migration. Most of the women are involved in extraction of palm fiber for earning money for their family needs and livelihood. CeFHA Intervention:The intervention of the CeFHA, the project initiated to create empowerment of women, quality of life and create income and food security among the women. Project has been Identified the women’s issues in the families and in society, (like equal sharing, good education to children’s, good health, quality of life, unity of the women). The CeFHA has formed three women groups in the village one is Chaithanya women group with 12 members group, the second group is Sravanthi women group with 9 member’s group. The third group is Chitty pydithalli women group with 17 members group. After formation of the women group have started monthly saving in the bank. Training programme:

The Project was planned to generate income security programs, they identified skills on urban based. Some of the women came forward to learn Tailoring. The women coordinators organized women group meetings to discuss on training programme. The group identified the interested women 19 members of group who are showing interested on tailoring. The project initiated training and completed it for three months. They have completed 3 months training programme successfully. They learn different varieties of dress materials. (Like Petty coats, Pillow covers, Sari petty coats, blouse, chudedhar dress). After completion of the training programme they have decided to start tailoring unit in their village. It gives some income to the support family. The women group members also came forward to contribute teacher’s accommodation and place of training center and some materials for the unit like threads, measuring scales and Babins. After training programme:

The women group organized a group meeting o for starting a Tailoring unit. During the meeting they took the decision to contribute etch trainer Two hundred rupees and they want to take loan from the women group fund Rs.10, 000-/ as the group is holding fund at the village and every month they decided to repay with interest Rs500-/ to their group savings. They purchased two tailoring machines and they started two units working 12 members group. They were charging each dress Like Petty coats-Rs 15-/ , Pillow covers Rs.10-/, Sari petty coats Rs.20-/, blouse Rs.70-/, chudedhar dress Rs.150-/) now they are earning money from the unit. 3. CASE STUDY ON SELF HELP GROUP - IGP UNIT- C .B. PALLIINTRODUCTION:CB Palli Village belongs to the Panchayat head quarter and this village coming under the Kotauratla mandal & police station limits 18 km. In this village there are different communities like Velama a, Dalit and other communities are living together. CeFHA is working with dalith communities in CB Palli village. There are 35 families and the population is 140. In this village 8 families are having slop land and 27 families are land less. All families are depending upon labor work and migration. Most of the families, the men spend on liquor and their income goes to the unproductive expenses. The woman has to look after family maintenance and livelihood. INTERVENTION OF CeFHA:Intervention of the CeFHA project to develop empowering among the women group and create income and food security. The project as identified the issues like Untouchablility, unproductive expenses, poverty, health, education. Staff of CeFHA formed a women group with 21 members and they have given name of women group Durga Devi. CeFHA has followed a principle to make people self sustainable. It has helped them understand the rich resources they possess internally as well as externally. The project activities were designed in such a way to help sustain their present system in longer Time. WOMEN GROUP MEETINGS IN THE VILLAGE

TRAINING PROGRAMME:The project organized deferent skills and technology training programs like IGP Surf making, Vim powder, Vaseline, etc. the project introduce urban based skills and up gradation of various local skills. The project identified local demand of products like Surf, Vim powder, Vaseline, fine oil. Where the raw material are easily available near by town and staff discussed with women group about the local markets and self use. WOMEN GROUP IGP UNITThe use of products in local market has demand and it’s much cost in the shops. The women group members have undergone two days training on IGP programme. After training programme they have started 10 members group of IGP Unit. Earlier each family has to spend Rs.150-/ for purchasing of surf, vim powder, and Vaseline and phenol for their personal hygiene. Now they are using their own product and they are saving Rs.150-/ and they are earning Rs.200-/ to Rs.300-/ out of the products. WOMEN INDIVIDUAL BUSINESS CASE STUDIES1. CASE STUDY ON WOMAN INDIVIDUAL BUSINESS

|

Centre for Humanitarian Assistance Trust, Flat.No-501, Revathi Hill, Balaya Sastri LayOut, Seethammadhara, Visakhapatnam 530013 |

© 2012 - 2013 | All Rights Reserved - CefHA Designed & Developed |

Kunkuma barina

Kunkuma barina Crane

Crane Lord Ganesha

Lord Ganesha Veena

Veena Candle stand

Candle stand Hair clip

Hair clip Mobile stand

Mobile stand Lord Ganesha

Lord Ganesha